The European Union (EU) could meet an initiative of effectively utilizing 90 percent renewable energy, only, by 2050 via adding intelligence to its existing grids and building a cross-border infrastructure, also known as a smart grid, according to a study by Greenpeace and the European Renewable Energy Council (EREC), an industry group. The report published last week states that with the appropriate policy, Europe’s grid infrastructure could be improved to incorporate clean, renewables on a much wider scale. Previously, the EU's Renewables Directive approved a binding goal requiring 20 percent of the bloc's energy supply to be derived from renewable sources by 2020. Regardless, Europe's electricity grids, as in most other parts of the world, were originally built to handle large centralized power plants rather than large amounts of decentralized or distributed power produced by smaller-scale sources.

Thursday, February 11, 2010

EU Smart Grid Initiative for Total Renewable Energy Conversion

Tuesday, February 2, 2010

Hydropower Rides Wave of Clean Energy Stimulus

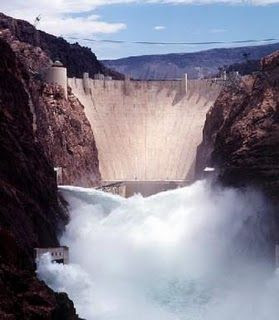

Hydropower is the long-forgotten and under-appreciated sibling of the renewable energy family. It does not garner a fraction of the media attention of solar, and many people do not even realize it is a renewable energy source. Moreover, it was a challenge to have it incorporated into clean energy stimulus programs. According to 2008 U.S. Department of Energy (DOE) statistics, renewable energy was responsible for only 7 percent of America's power supply, and 34 percent of that amount was derived from hydropower and while only 1 percent was from solar. However, as important as hydropower has been in the past, it has many more limitations in terms of land development due to environmental and sustainability issues than solar, as the country shifts towards a higher degree of clean energy.

Beyond the use of conventional hydropower technology, there is increasing government interest in developing new power generation derived from the ocean and in-stream kinetic energy potential. Since pumped-storage hydropower is the only large-scale storage option available at this time, the National Hydropower Association (NHA) argues that increasing wind and other variable renewable generation technologies requires building additional pumped storage, as a stable back-up energy source. According to the Energy Information Administration, there is 20,000 MW of operating pumped-storage capacity in the U.S.; developers have proposed constructing another 23,000 MW. Moreover, current U.S. hydropower generation avoids approximately 225 million metric tons of carbon emissions from entering the atmosphere each year.

Growing interest in non-hydro renewables such as solar, wind, biomass and geothermal is also increasing funding emphasis on the hydropower industry. DOE has stated that to integrate the wind resources needed to generate 20 percent of U.S. electricity by 2030, which is an unofficial national goal, the U.S. will need an additional 50,000 MW of peaking or storage capacity. This point enabled the NHA to successfully lobby for including additional tax incentives for hydropower in national economic stimulus programs. The Recovery Act extends the placed-in-service date through December 31, 2013, for small irrigation hydro, incremental hydropower from additions to existing hydro plants, hydropower development at existing non-powered dams, ocean energy and in-stream hydrokinetic technologies projects. This funding requires that developers of these projects complete the work in five years.

The Recovery Act clean energy stimulus also allows hydropower projects to claim a 30 percent investment tax credit (ITC) in lieu of a production tax credit (PTC), both of which have been extended through 2013. The ITC is aimed at opening up more financing for renewables projects in lieu of the tightened credit markets in the past year. Another incentive available to a hydropower facility, if the facility refuses the PTC and the ITC, is a grant issued from the Secretary of the Treasury worth 30 percent of the cost of the project.

This same legislation also authorizes $1.6 billion of new clean renewable energy bonds (CREBs), which is an option for public power providers to the PTC. It allows them to finance development of facilities that generate electricity from renewables such as hydropower. Furthermore, this stimulus program also created an advanced energy investment tax credit for companies that invest in clean energy technology manufacturing facilities. Hydropower equipment manufacturers are eligible to participate in the 30 percent credit if they upgrade, expand, or re-establish a facility to manufacture “property” for producing energy from the sun, wind, geothermal or hydro sources. The original provision provided the tax credits only for wind, solar and geothermal; however, the NHA staff successfully lobbied to ensure that the definition was expanded to include “other renewable resources;” thus, encompassing traditional hydropower and advanced hydrokinetics associated with ocean and river currents.

Even U.S. legislation has treated hydropower as an afterthought and oversight while developing policy for the clean energy stimulus, not including it in the initial mix for renewable energy funding. Part of that issue has been due to significantly less media attention and support from the top of the Obama Administration for hydropower in rebuilding the U.S. economy. Hydropower has a more limited supply chain than other renewables such as solar; therefore, it is less stimulative economically while it also has less exportation potential when compared to wind and solar components.

The DOE budget for hydropower underwent severe reductions under the Bush Administration, which was hardly supportive of any renewable sources in general. However, hydropower will ride the wave of increased support for clean energy in President Obama’s recently announced budget proposal, which includes $6 billion for related technologies, along with an increase of fees and elimination of tax breaks for oil and gas companies.